Excise Tax Consultants in the UAE

Which Goods does the Excise Tax in the UAE apply to?

Excise tax in the UAE applies to specific categories of goods, including:

- Tobacco and tobacco-related products – 100%

- Energy drinks – 100%

- Carbonated beverages – 50%

- Electronic smoking devices and tool – 100%

Liquids used in electronic smoking devices – 100%

FREE CONSULTATION

Importance of Excise Tax Consultants in the UAE

The complexity of legislation regarding excise taxes in the UAE and the possibility of hefty penalties for non-compliance make the value of excise tax consultants in the UAE undeniable. They offer strategic partnerships in compliance and guide businesses through the complicated legislation and regulations via:

- Determining taxability: Determining whether your business needs to register for excise tax or not.

- Preparing Documentation: Helping prepare trade licenses and customs reports, and excise goods documentation.

- FTA Registration Supervision: Making sure that application registration with the FTA is completed and submitted correctly to avoid delays.

- Returns and Payments: Submitting and paying excise taxes timely and avoiding the penalties that come from late submissions.

- Advisory and Audit Oversight: Guiding businesses through audits as well as informing them of changes and updates in excise tax law for continued compliance.

Contact Us

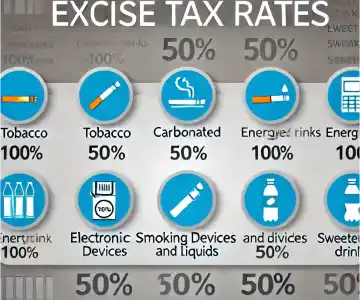

Excise Tax Rates in the UAE

Excise tax is charged at high rates to discourage consumption:

- 50% on carbonated drinks

- 100% on energy drinks

- 100% on tobacco and tobacco products

- 100% on electronic smoking devices and tools

- 100% on liquids used in electronic smoking devices

Registration Of Businesses for UAE Excise Tax

Within the context of the UAE’s excise tax law, multiple categories of enterprises must register for excise tax. This registration obligation applies the directive due to the law regulating the various activities in the production, storage, and importation of excise goods. The following are the key entities that must register: The following are the key entities that must register:

- Warehouse Operators:- Excise tax is mandatory for any business that owns a warehouse, or if you have a designated area for storing excise goods in the UAE.

- Stockpilers of Excise Goods:- Other categories are those industries and businesses who store excise goods, though they themselves do not manufacture or import such goods are also obliged to register. This consists of any company which possesses a large quantity of the excise goods for the purpose of selling or supplying them in the UAE.

- Manufacturers of Excise Goods:- The companies that manufacture excise goods for local consumption in the UAE must pay excise tax and, therefore, register for it. This makes sure that all manufactured local excise goods are recorded.

- Importers of Excise Goods:- It is mandatory for any business that deals in goods that are subjected to excise tax in the UAE to sign up for the tax. This requirement is regardless of the goods for domestic consumption or to be imported to other stores in the UAE.

- Non-registration for excise tax:- If a person prefers not to get registration,it attracts other penalties to any business engaged in any of these activities, it’s then wise for business to be price conscious.

Contact Us

Excise tax exemptions in the UAE:-

Under UAE’s excise tax law, the following are the key exemptions under the law:

- Occasional Importers:- In this case, the regular importer or any other person/ company that imports the goods occasionally can be relieved from paying excise tax. Nevertheless, they have to convince the authorities that their importation activities are exceptional and do not fit under business activity.

- Exporters of Excise Goods:- Any excise goods that are intended for exportation out of the United Arab Emirates do not attract the excise tax. This exemption is aimed at preventing Normal Excise tax from being levied on goods that are not used locally in the UAE hence leading to extra taxation.Nevertheless, to benefit from these exemptions, the companies are still required to submit their transactions and reports to the FTA and such documentation as may be required to substantiate the exemptions.

What Is the Procedure To Get Register for UAE Excise Tax?

Excise tax registration in the UAE can be done with the assistance of Excise tax consultants that doesn’t not take much of the time.The Excise tax consultants can help the taxpayer to pays much attention to some of the things to look out for registration:-

- Understand Your Obligations:- The taxpayer should understand the excise tax law before registering hence the need for businesses to be well informed. This entails establishing whether their operations are regulated by the law and pronouncing on the excise goods that they trade in.

- Register via the Emaratax Portal:- The FTA also offers an e-services portal namely; Emaratax, that enables entities to register for excise tax. Application process is easy and applicants follow it through the registration process provided on the portal. It involves the process of signing in the business, general forms that are required to be filled in order to establish the account.

- Provide Required Information:- During registration, legal entities are obliged to submit information referring to the kinds of excise goods they work with, the types of business they perform, the places of their facilities, etc. In this case, there is a need to ensure all aspects of information provided are correct and refreshed for the current state.

- Submit Supporting Documents:- In most cases, the registration application may be accompanied by other relevant documents depending on the nature of the business. This may be related to such items as licenses, permits or proof of ownership of warehouses and /or manufacturing facilities.

- Registration Timeline:- Any business entity involved in excise activities must first be licensed by registering with the commissioner of excise tax before engaging in any of the activities of manufacturing or importing any excise goods or even keeping a stockpile of the excise goods. Where a business carries out taxable activities inconsistent with registration, he must register within thirty days of the end of the month in which he started to carry on the activities aforesaid.

Excise Tax Registration Deadline:- The writing and recording of the UAE’s excise tax law does not contain any explicit time frame, which businesses need to adhere to. But entities need to first get registered before they conduct any kind of business that is chargeable of tax. For those who have already embarked on such activities, registration has to be done not later than 30 days from the end of the calendar month in which the activities are conducted. This undertaking rolling deadline gives adequate time to the businessmen to comply with the law while at the same time putting a lot of pressure on the businessmen to register within the period provided.

Contact Us

Why Choose Us

Tax Consultant Dubai possesses immense expertise and experience in distinct industries. Our Excise Tax Consultants in the UAE provide:

- Simple and hassle-free registration with the FTA.

- Accurate preparation and submission of excise tax returns.

- Personalized excise tax advisory in the UAE.

- Representation in the event of audits.

- End-to-end compliance monitoring.

Contact us today, and we shall be glad to assist you.

Contact Us

FAQs